Corporate Governance

Governance

BOD Composition (as of March 28, 2024)

BOD Composition : Category, Name, Position & Duty, Career, Tenure

| Category |

Name |

Position & Duty |

Career |

Tenure |

| Executive Director |

Anwar A. Al-Hejazi |

RD & CEO |

- Former President of Saudi Aramco Asia

- Former CEO of Saudi Aramco Asia Japan

|

2023.5.9 ~ |

| Non-standing Director |

Mohammed Y. Al-Qahtani |

Chairman of CC |

- Saudi Aramco Downstream President

- Former Saudi Aramco Downstream EVP

- Former Saudi Aramco Upstream SVP

- Former Saudi Aramco Corporate Planning, Corporate Affairs, Petroleum Engineering & Development VP

|

2021.3.30 ~ |

| S.M. Al-Hereagi |

|

- Saudi Basic Industries Corporation 임원

- Former Saudi Aramco Treasury SVP

- Former Saudi Aramco Treasury VP

- Former Saudi Aramco Petroleum Overseas Managing Director

- Former Saudi Aramco Treasury Advisory, Treasury Services, Auditor Head

|

2016.3.18 ∼ |

| Motaz A. Al-Mashouk |

Chairman of ODCRC & ESGC |

- Saudi Aramco Senior Vice President

- Former Saudi Aramco Engineering Services SVP

- Former Saudi Aramco Maritime, Building & Infrastructure Project Management, Community Infrastructure & Public Project General Manager

|

2022.3.22 ∼ |

| Ibrahim M. Al-Nitaifi |

Member of ESGC |

- Saudi Aramco Vice President

- Former Saudi Aramco Fuels Affiliates Affairs VP

- Former Saudi Aramco Fuels Affiliates Affairs General Manager

- Former Saudi Aramco Mobil Refinery Company President & CEO

|

2023.3.28 ∼ |

| Outside Director |

O-Kyu Kwon |

Chairman of the Board of Directors |

- Former Chairman of the Hyundai Motor Chung Mong-Koo Foundation

- Former visiting professor at KAIST Collegue of Business

- Former Deputy Prime Minister and Chief of the Ministry of Strategy and Finance

|

2023.3.28 ~ |

| Jae-Hoon Lee |

Chairman of BAC, Member of CC |

- Advisor at Kim & Chang

- Former Commissioner of Presidential Committee on Green Growth

- Former Chairman of Energy Future Forum, Energy Valley Forum

- Former President of Korea Polytechnic University

- Former Vice Minister of Trade, Industry and Energy

|

2021.3.30 ∼ |

| Jungsoon Janice Lee (female) |

Member of CC, ODCRC & ESGC |

- Advisor at Kim & Chang

- Former CFO of Standard Chartered Bank Korea

- Former SVP of Hanaro Telecom

- Former Controller of Daewoo Heavy Industries America

|

2019.3.28 ∼ |

| Jeon-Hwan Lee |

Member of BAC, ODCRC & ESGC |

- Advisor at Bae, Kim & Lee

- Former Vice Commissioner of National Tax Service (NTS)

- Former Assistant Commissioner of NTS Individual Taxation Bureau

- Former Commissioner of NTS Busan Regional Office

|

2021.3.30 ∼ |

| Seung-Beom Koh |

Member of BAC, ODCRC & ESGC |

- Former Chairman of Financial Services Commission

- Former member of the Monetary Policy Board, the Bank of Korea

|

2024.3.28 ∼ |

| Eun-Hyung Lee (female) |

Member of BAC, CC |

- Professor at the College of Business, Kookmin University

- Former member of Deliberation Committee of Regulation-Free Special Zone

- Former Chairman of the Board of Directors at Standard Chartered Bank Korea

|

2024.3.28 ∼ |

The BOD is organized as a one-tier board system in accordance with domestic law.

Balance between Diversity and Independence

S-OIL nominates director candidates with expertise and diversity, including nationality, race, gender, etc., in accordance with internal procedures to ensure that the interests of various stakeholders are properly represented and that mutual complementarity among directors can be maintained. Candidates are formally appointed as directors at the Annual General Meeting. Based on the essential competencies of the Board, the Company select candidates by reviewing their vision, leadership, expertise and professional experience, as well as their ability and qualifications to serve independently and objectively on the Board. To ensure the independence of the Board, a candidate is also screened for factors that may be material to his or her ability to serve. Thus, whether he/she works or has worked for S-OIL in the past five years, whether he/she performs or has performed any audit or consulting services for the company, and whether he/she has any material relationship or transaction with the company are fully considered.

Independence Policy of Outside Directors

In order to assist the Board of Directors in making independent and objective decisions to protect the rights of shareholders and investors, S-OIL appoints a majority of directors as outside directors who meet the following independence policy (disqualification grounds). Outside directors will lose their positions if they fail to meet the independence policy.

- Directors, executive officers and employees who are, or have been within the past five years, directors, auditors, executive officers and employees of the Company

- The principal, his/her spouse, lineal ascendants, and lineal descen¬dants, in cases where the largest shareholder is a natural person

- The principal, his/her spouse, lineal ascendants and lineal descendants in cases where the largest shareholder is an individual

- Directors, auditors, officers and employees of a corporation, if the corporation is the largest shareholder

- The spouses, lineal ascendants, and lineal descendants of directors, auditors, and executive officers who have engaged in the Company or a parent company and a subsidiary of the Company within the last three years

- Directors, auditors, executive officers and employees who are en¬gaged in a parent company and a subsidiary of the Company within the last five years

- Directors, auditors, executive officers and employees of a corporation in an important interest such as a business relationship with the Company as follows

- The Company's important customers, suppliers and related per-sons

- A corporation that concludes an advisory agreement such as legal advice, management consultation, etc. with the Company or top management of the Company

- A corporate that contracts a private service agreement with the company or top management of the Company

- An accounting firm that has been the auditor of the Company with¬in the last three years

- A non-profit organization and related persons that receives im-portant donations from the Company, etc.

- Directors, auditors, executive officers and employees of another company for which directors, executive officers and employees of the Company serve as directors and executive officers

- A person who is determined to undermine the independence of the BOD due to other interests with the Company or who is otherwise unable to faithfully perform his/her duties as an outside director

For outside directors, in particular, the Outside Director Candidates Recommendation Committee (ODCRC) recommends the most suitable candidates with independence, after evaluating candidates in accordance with internal standards to confirm that they have no vested interest in S-OIL or any other reasons for dis¬qualification. The Company has also developed a database of over 200 outside director candidates to ensure the Company can recommend the right candidates in a timely fashion. The Board leverages the expertise and diverse experience that directors bring from various areas, including accounting/finance, business strategy/management and policy, as well as business objectives related to refining and new energy, and two female directors have been serving on the board since 2019, further enhancing its diversity. Having served in various fields, such as the government, industry, and academia, directors with rich experience and capa¬bility in the energy and chemical industry will significantly contrib¬ute to enhancing the diversity and independence of the BOD.

Board Skill Matrix

Board Skill Matrix : Professionalism, Business Purpose related, ESG, Accounting / Finance, Management Strategy / Administration, Policy

| Professionalism |

Business Purpose related

(e.g., refining, petrochemicals, new energy, new business) |

ESG |

Accounting / Finance |

Management Strategy / Administration |

Policy

(planning and finance, industry, trade, etc.) |

| Inside Director & Non-standing Director |

Anwar A. Al Hejazi |

● |

- |

- |

● |

- |

| Mohammed Y. Al-Qahtani |

● |

- |

- |

● |

- |

| Salah M. Al-Hereagi |

● |

- |

● |

● |

- |

| Motaz A. Al-Mashouk |

● |

● |

- |

● |

- |

| Ibrahim M. Al Nitaifi |

● |

● |

- |

● |

- |

| Outside Director |

O-Kyu Kwon |

- |

- |

● |

● |

● |

| Jae-Hoon Lee |

● |

- |

- |

● |

● |

| Jungsoon Janice Lee |

- |

● |

● |

● |

- |

| Jeon-Hwan Lee |

- |

- |

● |

● |

● |

| Seung-Beom Koh |

- |

- |

● |

● |

● |

| Eun-Hyung Lee |

● |

● |

- |

● |

- |

Enhancing Professionalism in BOD

To ensure professionalism in the formation of the Board of Directors, S-OIL regularly conducts a briefing session to support the Board's decision-making, including general content such as changes in the business environment, business strategies, risk factors, and risk management measures. Directors receive a monthly report on economic, social and environmental issues that may affect the Company's sustainability. The BOD operates four committees (Board Audit Committee (BAC), Compensation Committee (CC), ODCRC and ESG Committee (ESGC)) to support its independence and efficient decision-making.

The Management Committee, which supports the CEO, contributes to the Company's sustainable growth by analyzing critical economic, social, and environmental issues in advance to ensure the Board's sound decision-making in all areas, including business plans, budget, and labor policies. In addition, the Company evaluates the Board and outside directors through an annual self-assessment.

Balance between Checks and Cooperation

S-OIL establishes sound and transparent corporate governance led by the BOD and its committees, ensuring a balance between checks and cooperation. The majority of directors are appointed as outside directors who have been vetted for independence according to our internal policy. An independent outside director has served as the chairman of the BOD since 2015, and all members except for the CEO who is an executive director are non-standing directors.

This ensures decisions are made in a manner that maximizes value for various stakeholders based on the objective and independent functioning of the BOD to oversee and check the management activities and performance of the CEO and the Company. The Company makes sure that the attendance rate of each director at the Board of Directors' meeting remains above 75% each year, except in exceptional circumstances, so that checks and cooperation can be achieved through the active participation of directors. In addition, the BAC, composed entirely of outside directors, evaluates general management issues and the operational status of the internal accounting management system, and receives internal audit performance reports. S-OIL prohibits its outside directors from serving as directors of two or more companies in addition to the Company, and all outside directors fulfill this requirement.

Executive Remuneration Policy

S-OIL compensates its executives in accordance with objective and transparent procedures to ensure that all executives, including the CEO, are committed to protecting shareholder value and fulfilling their roles as corporate citizens. Comprised of non-standing and outside directors to ensure the independence and fairness of compensation decisions, the Compensation Committee (CC) convenes annually to ensure that the level of compensation paid to executives is appropriate, and determines compensation based on the achievement of objectively established short- and long-term goals. The CC determines the level of individual variable compensation for all executives by comprehensively considering not only short-term management performance, which includes both financial factors (e.g., ROACE and EBITDA) and non-financial factors (safety and annual carbon abatement and other ESG-related factors), but also the achievement of the Company's mid- to long-term management performance goals (e.g., total shareholder return (TSR). The Company also transparently discloses the basis and amount of directors' compensation through its business reports.

Furthermore, the Company has strengthened accountability management by establishing a system that requires directors, including the CEO, to directly compensate the Company for any damages caused to the Company. The scope of liability extends to damages caused by failing to faithfully perform their professional responsibilities, not just violations of laws and regulations or the Articles of Incorporation. In principle, directors are required to compensate the entire amount of damages, but the amount of compensation may be limited to six times the annual compensation (three times for outside directors) by a resolution of the shareholders' meeting.

Charter of Corporate Governance

- Charter of Corporate Governance

- View PDF

- Corporate Governance Report

- View PDF

Sound and Transparent Financial Management

Governance

The Company manages its financial activities in accordance with the Financial Operations Policies. To ensure financial soundness, it operates within key financial limits approved annually by the Board of Directors, such as the total debt limit, minimum cash balance, and net dollar liabilities limit. Additionally, to ensure transparent information disclosure, the Company has established and operates disclosure management regulations. The CFO has been appointed as the disclosure officer to systematically carry out disclosure activities.

Strategy

Financial Soundness and Efficient Financial Management

S-OIL regularly forecasts future cash flows to ensure timely funding while minimizing unnecessary borrowing. In 2023, the Company maintained financial integrity with an adequate level of liquidity by implementing the company-wide profit improvement activities, efficiently managing working capital, and avoiding unnecessary budget execution.

The Company also maintains excellent credit ratings and actively communicate with local and international rating agencies about our financial flexibility, the availability of financial support from our parent company, Saudi Aramco, and our growth strategy.

Execution of optimal capital procurement

In November 2022, S-OIL made the final investment decision for the Shaheen project to secure future growth momentum and commenced project implementation. The Company has established an optimal financing plan for the project based on our prudent financial management policy and are executing it as planned.

Since the process design of the project, efforts were made to reduce carbon emissions by adopting the most energy-saving technologies and applying a variety of concepts, which led to the project being recognized as a facility investment with lower carbon emissions compared to the existing facility, and to the receipt of a KRW1 trillion industrial facility loan at competitive interest. The Company is also working closely with our parent company, Saudi Aramco, to secure a more stable source of funding through the establishment of a USD 600 million shareholder loan at a below-market rate.

S-OIL continues to strive to reduce its financing costs, not only for strategic project financing but also for day-to-day operations, by raising working capital in a timely manner and at competitive terms. In June 2023, the Company issued KRW 350 billion of corporate bonds at competitive terms to redeem maturing existing corporate bonds by maintaining excellent credit ratings, raising our credit rating outlook, and actively attracting investors. The Company also postponed the issuance of a refinancing scheduled for the second half of 2023 to January 2024, in light of the then-high interest rates and the prospect of future declining interest rates, thereby lowering our financing costs. Going forward, the Company will continue to strengthen our financing competitiveness by closely evaluating various capital raising options and financial market conditions.

Balanced Dividend Policy

S-OIL is committed to maximizing long-term shareholder value by returning the Company's earnings to shareholders in a balanced manner, taking into account maintaining financial soundness, retaining profits to secure future growth engines, and returning profits to shareholders. The Company pursues a dividend policy of allocating its earnings in a reasonable and balanced manner to secure investment resources, maintain the soundness of its financial structure, and return to shareholders.

Along with this policy, the Company protects investors by increasing the predictability of our payout by disclosing specific dividend guidelines. In July 2023, our dividend guidelines were disclosed, which stated our intention to maintain our dividend payout ratio at approximately 20% of net income and above for fiscal 2023-2024. In 2023, the Company paid dividends of KRW 1,700 per share on common stock and KRW 1,725 per share on preferred stock, including interim dividends, in accordance with our disclosed dividend guidelines.

Efforts for Efficient Budget Management

The Company systematically plans and executes budgets to make efficient use of limited resources. The Company strives to avoid budgeting unnecessary items and create budgets that are organically linked to the Company's management strategy and action plans, and require that the execution of budgeted items be subject to review by the relevant budget management team.

In 2023, despite the unavoidable increase in expenses due to sharp inflation, rising labor costs, and rising electricity prices, the Company carefully managed to execute the annual budget within the approved limit by carefully reviewing the necessity and justification of each budget item and ensuring that only essential expenses were executed efficiently, which resulted in a significant reduction in the fixed cost budget compared to the plan.

In 2024, the Company continues its cost reduction efforts across the organization to respond to the increasingly uncertain business environment, such as continued price inflation and government policy changes, as well as to strengthen our financial soundness for the successful implementation of large-scale projects. As part of the effort, the Company has optimized the 2024 budget to minimize unnecessary expense increases by keeping the overall fixed cost increase within the inflation rate, except for items related to the Company's key strategies including the Shaheen project, Digital Transformation, new energy business, and decarbonization. Going forward, the Company will continue to improve the efficiency of resource allocation and budget management through systematic and objective budgeting, line-item review of expense and investment budgets, and enhanced performance management.

Sincere Tax Payment

S-OIL takes it as an important responsibility as a respected corporate citizen to contribute to the national economy and social development through faithful tax payments. In accordance with its own tax policy, S-OIL observes the regulations, maintains an honest and transparent relationship with the tax authorities, and dutifully pays taxes. In addition, corporate income tax, deferred tax and effective tax rates are reported in detail through an audit report of independent auditors, and disclosed to the public through the electronic disclosure system of the Financial Supervisory Service.

Tax Policy

S-OIL adheres to the following tax policies, recognizing that contributing to the national economy and social development through sincere tax payment is an important responsibility of corporate citizens.

- The Company shall strictly comply with the tax policies, laws, and international standards (OECD Guidelines, etc.) of the country or region where the Company operates.

- The Company shall not violate tax laws or conduct inappropriate tax accounting activities for the purpose of tax avoidance.

- The Company shall not use tax havens for offshore tax evasion or inappropriate tax reduction.

- The Company shall not engage in any transactions related to the transfer of income between countries by engaging in transparent and fair foreign transactions.

- The Company shall apply objective and reasonable transfer prices for transactions with related parties in accordance with the arm's length principle.

IR Activities to Enhance Corporate Value

S-OIL actively engages in investor relations activities to provide shareholders and investors with management information in a transparent manner and to enhance corporate value. Every year, the Company surveys analysts on their satisfaction with our IR activities and then incorporate their feedback to improve the quality of IR activities.

Transparent sharing of management information through active IR activities not only protects shareholders and investors by eliminating information asymmetries, but also enhances investor confidence in the Company, allowing for proper valuation of the Company's value. Investor confidence built through IR activities protects shareholder value and management's reputation, which in turn leads to an improved corporate image, creating a virtuous cycle of fair valuation and stable share prices, which are important indicators of corporate value.

In 2023, the Company held four earnings calls for domestic and overseas investors, 10 in-person and virtual Non-Deal Roadshows (NDRs) in Korea and overseas, attended 10 major domestic and overseas conferences hosted by securities firms, and held 326 meetings with domestic and overseas investors, all of which helped to transparently communicate our business information to stakeholders through active IR activities. Every quarter, the Company hold earnings announcements to provide detailed financial results along with analysis and outlook for the future. The Company also proactively communicates its major achievements and future plans to investors and analysts, including its digitalization strategy, ESG management status, Shaheen Project progress, and decarbonization roadmap. Going forward, S-OIL will continue to make every effort to communicate with stakeholders its vision and efforts to respond to the rapidly changing business environment and achieve sustainable growth.

Investor Communications

Investor Communications : Category, 2020, 2021, 2022, 2023

| Category |

2020 |

2021 |

2022 |

2023 |

| Earning call |

4 |

4 |

4 |

4 |

| Domestic / overseas NDR |

4 |

4 |

8 |

10 |

| Investor conference |

11 |

11 |

11 |

10 |

| Shaheen Project Briefing |

- |

- |

1 |

- |

Risk Management

Financial Risk Management through Employee Training and Disclosure Compliance

Disclosure is one of the fundamental obligations of a listed company and is designed to ensure fairness in the securities market and to protect shareholders and investors by providing timely, fair and complete information to its stakeholders, including shareholders, creditors and consumers, about material decisions and changes in financial condition that affect the value of the Company. If a company fails to make such disclosures as required by law, it not only fails to protect its shareholders and investors, but also faces legal sanctions and loses credibility.

Accordingly, disclosure training familiarizes all employees, not just those responsible for disclosure, with the importance of disclosure and its rules, enabling timely and lawful disclosure, thereby enhancing shareholders' and investors' confidence in the Company and avoiding risks such as legal sanctions for non-compliance.

The Company closely monitors new and revised laws and regulations related to disclosure, conduct relevant training to prevent disclosure omissions and delays, and faithfully complete annual mandatory training for those in charge of and responsible for disclosure in order to enhance investor confidence and comply with relevant regulations. Through this strict compliance with disclosure regulations, the Company submitted a total of 66 disclosures, including voluntary disclosures, without a single violation in 2023, providing shareholders and investors with management information in a transparent manner. In 2024, the Company will continue to conduct disclosure training to raise employees' awareness of disclosure and continue to make timely and lawful disclosures.

Number of Disclosures Per Year

Number of Disclosures Per Year : Category, 2020, 2021, 2022, 2023

| Category |

2020 |

2021 |

2022 |

2023 |

| Number |

49 |

55 |

62 |

66 |

Metrics & Targets

To ensure financial soundness and transparency, S-OIL manages its credit ratings, dividend policy, financing plans and disclosure activities.

Financial soundness and transparency : Category, 2023 Targets, Performance in 2023, 2024 Targets

| Category |

2023 Targets |

Performance in 2023 |

2024 Targets |

| Securing financial soundness |

Maintenance of excellent credit ratings |

Maintained domestic ratings at AA0 (positive) & global ratings at Baa2 (stable) & BBB (stable) |

Maintenance of excellent credit ratings |

| Balanced performance sharing |

Announcing and adhering to a balanced dividend guideline that takes into account investment resources and financial strength |

Maintenance of excellent credit ratings (dividend policy) |

| Optimized financing |

Timely financing on competitive terms |

Optimized financing |

| Active disclosure and management |

Zero violation of public disclosure |

Zero violation of public disclosure |

Zero violation of public disclosure |

| 1 training session on public disclosure |

1 training session on public disclosure |

1 training session on public disclosure |

| Active IR activities |

24 investor communication events |

Active IR activities |

Cybersecurity

Governance

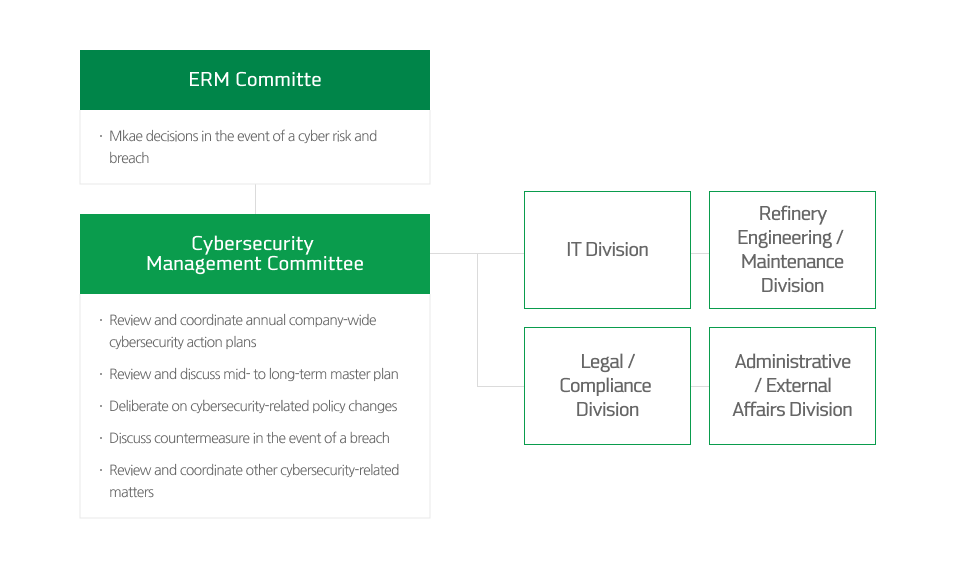

- ERM Committe

- Mkae decisions in the event of a cyber risk and breach

- Cybersecurity Management Committee

-

- Review and coordinate annual company-wide cybersecurity action plans

- Review and discuss mid- to long-term master plan

- Deliberate on cybersecurity-related policy changes

- Discuss countermeasure in the event of a breach

- Review and coordinate other cybersecurity-related matters

-

- IT Division

- Refinery Engineering / Maintenance Division

- Legal / Compliance Division

- Administrative / External Affairs Division

S-OIL has a Cybersecurity Management Committee, chaired by the Chief Information Security Officer (CISO), to report the company-wide cybersecurity strategy and action plan to the executive management, and to implement and supervise the execution of the approved plan.

The Cybersecurity Management Committee meets four times a year and is responsible for reviewing and coordinating the annual company-wide cybersecurity promotion plan, reviewing and discussing the mid- to long-term master plan, deliberating on cybersecurity-related policy changes in advance, discussing the countermeasures to be taken in the event of a breach, reporting to the Enterprise Risk Management Committee (ERM Committee) on important issues, and reviewing and coordinating other matters related to cybersecurity.

Strategy

S-OIL has implemented a cyber security management system based on global industry security standards such as the NIST Cybersecurity Framework (NIST-CSF), Oil and Natural Gas Subsector Cybersecurity Capability Maturity Model (ONG-C2M2), and domestic security standards such as ISMS-P. Based on this, the Company protects company-wide information and technology assets ranging from general information systems (Information Technology (IT)) and refinery control systems (Operational Technology (OT)) and make continuous efforts to improve the level of security maturity.

The Company also conducts a cybersecurity maturity assessment with external experts every three years. This provides objective results and confirms the reliability of our own cybersecurity performance. Based on the assessment results, the Company develops a master plan to strengthen our security posture and organize the plan into short-, medium-, and long-term timelines.

- Cybersecurity Policy

- View PDF

Enhanced Risk Monitoring for External Web Services

S-OIL has strengthened its vulnerability management and threat monitoring for external web services as the threat of cyber hacking continues to increase. In the quarterly evaluation of the security level of external web services by an external evaluation agency, S-OIL received a score of 9.9/10, which is in the top 1% of the global oil and gas industry.

Configuration of a secure OT network including Plant DMZ

The Company's secure OT network has been designed on the basis of IEC-62443, the international standard for industrial control system security. The network sets target security levels by function and role, and incorporates the principle of permission-based access control. This further strengthens the security of the OT network perimeter to minimize the risk of external hacking attempts.

Increased Awareness Against Phishing Emails

The Company has strengthened its awareness programs to increase employee vigilance against the recent trend of more sophisticated phishing emails. As part of this, the Company publishes regular security newsletters and conduct monthly phishing email drills to stay on top of the latest business email compromise attacks. Since 2023, the Company has seen a steady decrease in the number of victims and a significant increase in the number of malicious email reports by introducing rewards for those who report the most malicious emails and linking the malware drill infection rate to executive KPIs.

Maintaining ISMS-P Certification

In 2021, S-OIL became the first refiner in Korea to obtain the ISMS-P certification, which integrates the Information Security Management System (ISMS) and Personal Information Management System (PIMS), and in 2023, the Company passed the post-certification audit to maintain the ISMS-P certification.

S-OIL complies with the Personal Information Protection Act and collects personal information with the consent of customers by limiting it to necessary information. To minimize the risk of personal information leaks, S-OIL does not collect residential registration numbers and destroys all sensitive personal information as soon as it is no longer required. Led by the CISO, the Company is continuously improving relevant policies and processes to minimize the handling of personal information by business.

Risk Management

S-OIL's cyber risk management system is based on the Company's risk management policy and the ISO31000 international standard, and is governed by the Cybersecurity Risk Policy and Guidelines. The Company continuously monitors changes in the internal and external environment, including political, economic, market, technological, social and legal, to respond to increasingly sophisticated and advanced cyber threats, and newly identified threats are added to the risk register, followed by remediation activities and periodic status monitoring according to the identified risk level. These risk management activities are reported quarterly to the ERM Committee, which consists of top executives including the CEO.

-

- Analyze the environment and issues related to cyber threats by categorizing them into political, economic, market, technology, social, and legal to monitor and manage potential risks

-

- This stage is further broken down into risk identification, risk analysis, and risk rating

- Risk identification : Identify assets, threats, and vulnerabilities related to the risk

- Risk analysis : Create and analyze scenarios that may occur in relation to the identified assets, vulnerabilities, and threats

- Risk rating : Evaluate the probability and impact of risks based on the risk assessment matrix

-

- Develop and implement detailed risk mitigation plans (including scheduled completion dates, methods, budget, deliverables, and departments in charge

-

- Periodically update risk status and response requirements by monitoring implementation status and changes in the risk environment

- Report to the quarterly ERM Committee, which is composed of top executives, including the CEO

Metrics & Targets

S-OIL manages quantitative and qualitative indicators using multiple metrics to meet the needs of various stakeholders, including employees and customers.

Cybersecurity indicators : Category, 2023 Targets, Performance in 2023, 2024 Targets

| Category |

2023 Targets |

Performance in 2023 |

2024 Targets |

| Strengthening IT/OT security |

Establishing a 3-Year

cybersecurity master plan |

Established a 3-year

cybersecurity master plan |

Implementing a data mobile security system |

Strengthening preparedness

against intelligent malware |

Strengthened preparedness

against intelligent malware |

Implementing a cloud

technical security system |

| Enhancing customer and personal information protection efforts |

Maintaining ISMS-P certification

through follow-up audit |

Maintained ISMS-P certification

after follow-up audit |

Maintaining ISMS-P certification |

IT Cybersecurity

Maturity Level (0 - 5) |

3.30 |

3.30 |

3.40 |

OT Cybersecurity

Maturity Level (0 - 3) |

1.50 |

1.60 |

1.85 |

Ethics Management

Governance

Since 2004, S-OIL has operated the Ethics Committee consisting of the heads of Legal & Compliance Headquarter, Corporate Planning Division, Human Resources Division and Controller. They are appointed by the CEO after being screened for suitability by the Board Audit Committee (BAC). The committee is responsible for overseeing ethics management activities, including conflict of interest and anti-corruption measures, establishing ethics policies and system, revising the Code of Ethics, and enhancing ethical awareness in the organization, ensuring the best ethical decisions are made.

In particular, the committee must review transactions with the Company involving employees' interests that have a high potential for conflict of interest to prevent violations of the Code of Ethics. The committee annually reviews the results of ethical management activities, develops plans for enhancing ethics management, and then regularly reports these to the CEO and the BAC. Since 2018, S-OIL has conducted an annual stakeholder assessment of ethics management targeting employees, service stations, filling stations, corporate customers, and suppliers, on the Company's overall ethics management, including ethics awareness, respect for employees/customers/suppliers, abuse of dominant position, fairness in business transactions, and any experience with corruption, and reflected the assessment results in company policies to improve ethics management.

Strategy

Code of Business Ethics & Conduct

S-OIL closely monitors domestic and international trends, such as anti-graft laws and workplace harassment laws, and proactively reflect them in our Ethics Code, and all employees regularly submit a pledge of ethics compliance. In 2021, the Company improved the structure and content of the Ethics Code by benchmarking it against global best practices.

The Company has clarified the types of discrimination prohibited, such as race, nationality, gender, and age, and enhanced the content related to information protection (Article 7), protection and proper use of company assets (Article 8), fair competition (Article 9), anti-corruption/anti-bribery (Article 10), safety, health, and environmental policies (Article 11), prohibition of conflicts of interest (Articles 12 and 13), prohibition of acceptance of gifts, entertainment, and favors (Article 14), and whistleblower protection (Article 16). The Company also embraces the Ethics & Regulatory Compliance Framework (ERCF), the ethics and compliance standards of Saudi Aramco, our largest shareholder. Our Ethics Code extends to our suppliers, subsidiaries, and investment companies, and our suppliers are required to submit an ethics compliance pledge to comply with the Code. Should a supplier be found to be in violation of laws and regulations or engage in unethical behavior, it may be excluded from transactions or disadvantaged in its business dealings with S-OIL. In addition, to encourage the reporting of ethics management violations, S-OIL operates a whistleblower protection system, as well as an anonymous reporting channel and a self-reporting liability reduction system.

In addition, the Code strictly prohibits the provision of political funds or the use of the Company's organization, personnel, and assets for political purposes. In other words, the Company will strictly prevent political activities that deviate from their original purpose or activities that may adversely affect society. The Company will also continue to manage our purchasing, social contributions, and other activities to ensure that no expenditures are used to exert political pressure. In 2023, there were five Ethics Code violations and S-OIL took disciplinary measures against six employees in accordance with relevant regulations and procedures. Violation cases were also shared across the Company and covered in training for recurrence prevention purposes.

- Code of Business Ethics and Conduct

- View PDF

Ethical Management Training

Since 2009, S-OIL has been providing ethics management training tailored to different job grades and functions to raise employees' ethical awareness in their daily work, while also inviting outside experts for special lectures. Reflecting the results of stakeholder evaluation of S-OIL's ethics management, six courses on ethics management were offered in 2023, as well as case-based marketer training for sales offices that have a high probability of committing an ethics violation due to frequent encounters with business partners.

In addition, since 2013, the Company has offered ethics management training for suppliers and affiliates to help them understand the basic principles of our Ethics Code, thereby improving the quality of ethics management throughout the supply chain.

In 2022, the Company customized the training content to reflect the Ethics & Regulatory Compliance Framework (ERCF), Saudi Aramco's ethics compliance standards, as well as the latest trends and real-world cases in ethics management and conducted e-learning training. In addition, ethics management was added to the soft skills training introduced in 2023, as well as being integrated into the training provided for each job grade of the Company. Since 2015, the Company has also implemented the Ethics Management Self-Diagnosis System to enhance employees' understanding of the Code of Ethics.

Risk Management

S-OIL introduced the Compliance Monitoring System in 2011 to help employees better understand and adhere to the Company's internal policies in their daily work, thereby minimizing confusion and risks associated with non-compliance.

Currently, the Company conducts compliance monitoring activities twice a year based on 120 checklists covering 38 policies. The results are used in the performance evaluation of all managers and team leaders to encourage voluntary compliance by employees. In 2023, zero violations were identified through compliance monitoring.

Ethics Management Help Desk

- Tel

- 82-2-3772-5238

- Fax

- 82-2-3772-5239

- e-mail

- ethics@s-oil.com

- Website

- s-oil.com

Anti-Corruption and Ethics Audits

S-OIL regularly conducts audits and monitoring to ensure compliance with anti-corruption and the Code of Ethics in accordance with internal audit policies, detailed audit implementation procedures, and tip-off procedures. When establishing the five-year audit plan, the Company assesses various risks across by reflecting fraud risks for each process across all organizations. Regular internal audits are conducted at least once every three years for most organizations, except for those with minimal risks.

When developing the audit plan for each regular internal audit, fraud risks are integrated into the audit items and checklist to ensure auditors remain vigilant to the possibility of fraud. During the actual audit, the "Detailed Fraud Risk Checklist by Type" is utilized to examine potential violations of the Code of Ethics, such as corruption and embezzlement. The audit results related to fraud risks are then reported to the General Auditor.

In addition to regular audits, the Company rigorously investigates potential ethics violations reported through its tip-off hotline. In addition, the Company is monitoring continuously anomalies across all organizational operations through the Audit Command Language (ACL) software. The Company has may constant monitoring scenarios that can identify signs of fraud, and the Company performs quarterly monitoring of most scenarios to ensure that anomalies are thoroughly reviewed.

Metrics & Targets

S-OIL has set a goal of 'Zero Violations' for ethics management and is actively encouraging all employees to comply with our ethical standards by making it an annual goal. Through this ambitious goal, the Company will work to build an organizational culture in which ethics management guides employee decisions and behavior.

Ethics Management : Category, 2023 Targets, Performance in 2023, 2024 Targets

| Category |

2023 Targets |

Performance in 2023 |

2024 Targets |

| Number of ethics violations |

0 |

5 |

0 |

Stakeholder ethics management evaluation

(unit : points) |

9 or above |

9.29 |

9 or above |

While the goal of zero ethics violations is not realistically achievable, the Company is working toward it by setting it as a goal each year.

Compliance Management

Governance

The Legal & Compliance Headquarter ensures its independence from other departments, alignment with strategic targets, close coordination on company-wide issues by operating under the direct supervision of the CEO through the General Counsel, who leads the headquarter. The General Counsel directly reports to the CEO in a timely manner if he/she determines there is a legal risk that could significantly impact the Company. In addition to supporting legal compliance through a systematic compliance system, the Legal & Compliance Headquarter strives to ensure that all employees are fully aware of relevant domestic and international laws and regulations, as well as internal policies, and comply with them naturally in the course of their work.

The Legal Division provides timely legal review of all contracts that the Company enters into, and maintains ongoing communication with those involved with stakeholders on long-term projects to identify and minimize possible risks through careful legal review. In the event of civil, criminal, and administrative cases, S-OIL provides timely legal advice and actively responds to protect the interests of the Company, its employees, and stakeholders by appointing the best external specialized law firms, if necessary. In addition, in order to respond effectively and in advance to the strengthened Occupational Safety and Health Act and the Serious Accidents Punishment Act, the Company is preventing disputes and penalties by providing the necessary legal advice and reviewing individual contracts.

Through a dedicated team of legal experts, the Company focuses on preventing legal issues and disputes by thoroughly reviewing the latest legal trends, laws and regulations, and contracts related to major businesses and projects to assist management in making legal judgments in advance. As Compliance Officer, the Head of the Legal & Compliance Headquarter actively practices compliance by operating the compliance system.

Strategy

S-OIL has a specialized legal team to carefully review and prevent legal issues and contracts. When legal disputes do arise, the Company seeks the optimal solution without compromising trust with stakeholders.

This approach allows us to minimize the risk of legal disputes while further strengthening trust with our stakeholders. By practicing compliance management, which is the foundation of ESG, the Company ultimately contributes to the company's goal of environmentally responsible growth. The Company will continue to make every effort to lead the way in compliance management.

Compliance Management as Corporate Culture

Led by the strong commitment of top management to compliance management and the active involvement of employees in practicing it in their daily work, S-OIL has embedded compliance management in its corporate culture. All employees integrate compliance standards into their day-to-day work and are mindful of compliance in the performance of their duties.

Major compliance activities are regularly reported to top management to draw attention to the importance of compliance management. In addition, the Company raises employee awareness of compliance by distributing compliance newsletters, disseminating compliance trends led by global companies, and providing various compliance programs such as compliance campaigns. The Company conducts in-depth analyses of laws and regulations, develop policies and provide customized training to further strengthen compliance management.

Systematic Compliance System

S-OIL takes a systematic approach to compliance management, using profiles and checklists for company-related laws and regulations to help employees practice compliance management. The IT-based compliance system allows employees to access it at any time for easy and convenient compliance activities.

The system also provides real-time, up-to-the-minute information on the latest laws and revisions, making it convenient for employees to search for or request legal information relevant to their jobs and to conduct compliance activities on their own through regular or ad hoc inspections.

Effective Response to Industrial Accidents and Legal Support for New Projects

The Company has established a security management system required by law and have made thorough and demonstrable preparations to comply with the law. In doing so, the Company has put in place a systematic safety compliance system to minimize our exposure to criminal liability.

In addition, the Company has provided legal support for major projects, including the Shaheen project, to minimize legal risks related to occupational safety that may arise during construction. The Company has also provided legal support on individual matters, such as the bidding and contracting procedures associated with the project, and the Company has provided comprehensive legal advice on new business ventures such as the biofuel business to mitigate legal risks.

Compliance Activities related to Supply Chain

S-OIL proactively addresses global supply chain regulations by collecting and sharing relevant domestic and international legal information across the Company. The Company has distributed guidelines and standard contract clauses that can be practically utilized by relevant departments in their transactions with partners.

This initiative particularly considers the EU jurisdiction's regulations (Corporate Sustainability Due Diligence Directive), which hold a leading position in supply chain regulation. The Company will continue to monitor trends in the enactment and revision of domestic and international laws, striving to promote compliance management for both S-OIL and its partners.

Legal Advice and Litigation Response

The Legal & Compliance Office prevents future legal risks and disputes and protects the Company's rights and interests by providing legal advice on all matters requiring legal review and reviewing contracts and external documents to which the Company is a party.

When tort litigation arises, the Legal & Compliance Office identifies the key elements of the dispute, develops an aggressive defense, and gathers evidence and outside expert advice as needed to not only defend against various claims, but also maximize the Company's interests.

Risk Management

ISO 37301 Certification for Compliance Management System

On May 13, 2021, S-OIL became the first company in the world to be certified to ISO 37301, the international standard for compliance management systems, and has since maintained this certification through annual follow-up audits. This means that the Company's compliance system is operating effectively and successfully for the systematic practice of compliance management.

S-OIL's efforts to practice compliance management and establish a culture of compliance for all employees by appointing the Compliance Officer in 2013 and implementing the compliance system in 2014 resulted in the world's first ISO 37301 certification in 2021 and recertification since then.

Risk Management

Governance

ERM Committee

S-OIL operates the ERM Committee, composed of top executives including the CEO, as the highest decision-making body for enterprise-wide risk management activities. The committee, which meets on a quarterly basis, sets the direction of enterprise-wide risk management to ensure strategic alignment between the Company's management policies and its risk management activities, and reviews the status of risk management.

The committee also performs a final review of risk management activities performed by risk owners each quarter, directs necessary response actions, and determines company-wide risk management principles. In 2023, the ERM Committee held four meetings to report and review major changes in the internal and external business environment, risk monitoring results, the business continuity management system, and risk response activities. In addition, since 2022, the Company have reported annually to the Board Audit Committee on the status of enterprise-wide risk management, improvement progress, and plans.

ERM Sub-Committee

To prevent risks that could hinder the achievement of management goals from materializing, the Company designates risk owners to systematically manage the process of identifying, evaluating, monitoring, and responding to risks.

In addition, the Company has established ERM subcommittees in manufacturing, marketing, strategy, Finance, and IT to review and assist risk owners in their efforts to manage risk effectively and make recommendations to the ERM Committee. In addition, from 2021, S-OIL expanded the management of major risk issues, which had been selectively implemented since 2015, to conduct a comprehensive environmental analysis of each major risk on a quarterly basis under the leadership of the risk owner to effectively identify potential risks at an early stage and respond proactively.

Board Audit Committee and Audit Organization

There is an audit organization that reports directly to the Board Audit Committee (BAC) to ensure the independence and expertise of the internal audit function. The BAC directly appoints external auditors and evaluates the internal accounting management system through an independent and objective evaluation in accordance with the relevant procedures for the appointment of external auditors and the IAMS evaluation.

The Company continues to enhance its transparency and corporate value through rigorous internal audits of accounting, ethics and compliance, and overall business operations. Based on its extensive experience and in-depth understanding of the business, the audit organization focuses on maintaining a sound internal control system and improving inefficient work processes and cost structures.

Strategy

Since 2008, S-OIL has operated a highly sophisticated enterprise risk management system (ERM) to allow all members of the Company to respond quickly and effectively to various risks that may arise from business activities. Each risk has a designated risk owner who continuously assesses and proactively responds to the risk in accordance with the enterprise-wide risk management system. The ERM Subcommittee supports the activities of these risk owners and reports to the ERM Committee on the optimal response.

The ERM Committee, as the highest risk management decision-making body, establishes risk management policies in line with the Company's strategy, oversees the activities of each risk owner, and makes final decisions. S-OIL's enterprise-wide risk management system is composed of three main stages: risk prevention, emergency response in the event of a crisis, and business normalization after crisis response.

The Company has established a six-step risk management process (1) analysis of the business environment, 2) identification of risk factors, 3) evaluation of risk controls, 4) assessment of the probability and impact of risks, 5) establishment and implementation of additional countermeasures, and 6) monitoring and reporting of risks to management) to prevent the occurrence of risks in our daily operations. In the event of a crisis, the Emergency Control Program, an enterprise-wide emergency response system, is activated to minimize damage to people and property, and the Business Continuity Management (BCM) program, newly introduced in 2023, lays the foundation for the rapid resumption of normal business activities after a crisis.

Risk Management

Establishment of Business Continuity Management (BCM)

In May 2023, the Company established the BCM system to ensure undisrupted supply of our products in the event of a crisis such as a natural disaster or fire explosion. Together with the implementation of the system, the Company has documented the activities of the countermeasures to ensure continuity of product supply.

The Company further strengthens its corporate risk management capabilities by activating the BCM Committee to review and systematically support all activities to ensure rapid plant recovery and product supply continuity through company-wide cooperation when the expected period of product production interruption exceeds the recovery target time.

Early Warning System (EWS) Operation

The EWS is a system that periodically monitors a large amount of data generated during daily business operations according to predefined scenarios and enables preventive response activities. The EWS monitors anomalies according to 62 scenarios defined for finance, human resources, procurement, sales, and production, and quickly notifies relevant people to prevent risks from worsening or escalating through proactive risk review and response activities.

Emergency Control Program (ECP) Operation

The ECP is a company-wide emergency preparedness system that serves to swiftly minimize damage to people and property in the event of an emergency. The Company has established Emergency Control Centers at major business sites and periodically perform emer¬gency drills to strengthen its emergency response capabilities. In 2023, the Company held a company-wide emergency drill with top management participation that simulated a production process fire and casualties, enabling us to review and improve our emergency response processes and business continuity management system.

Internal Accounting Management System (IAMS) Establishment and Operation

Pursuant to the Act on External Audit of Stock Companies, the Company has implemented the IAMS to manage and review our internal control processes related to financial information in order to ensure the reliability of financial information. In particular, since 2023, the Company has newly established a consolidated IAMS with our subsidiary S-OIL Singapore Ptd. Ltd. in accordance with the Act and successfully put it into operation.

Furthermore, the effectiveness of the design and implementation of internal controls is evaluated on a regular basis, the findings of which are reviewed by external auditors and reported to the Board of Directors, the Board Audit Committee, and the General Meeting of Shareholders. The Company also conducts annual training for employees to improve their ability to operate the IAMS.

Effective Internal Audit System

To ensure efficient and effective internal audit, the Company ranks risks by organization or business process, taking into account the magnitude of risks and exposures, controls in place, and audit effectiveness, and formulate a five-year audit plan accordingly. The audit organization then conducts regular internal audits every two to five years based on the results of the risk assessment for all organizations throughout the Company in accordance with the five-year audit plan approved by the BAC, and conducts special audits for potentially significant risks. In addition, the Company shares past audit cases with business functions and strengthen the follow-up of audit recommendations to prevent similar cases from recurring.

To encourage reporting and protect whistleblowers, the Company actively communicates the Ethics Management Policy and whistleblower hotline to employees, business partners and suppliers. When reports come in, the Company thoroughly reviews and investigates the reports, and follow up on confirmed cases to prevent reoccurrence and to improve. The Company also continuously reviews internal audit policies and procedures, strengthens internal controls, and increases employee compliance awareness and self-audit mindset through regular and ad hoc audits based on a risk-based audit plan.

Internal Audit Performance

In 2023, the Company improved efficiency by recommending shortening the precious metal recovery cycle for waste catalysts at the plant, while continuing to monitor the Shaheen project for its successful implementation. In addition, the Company received the 'Generally Conforms' opinion, the highest level of internal audit quality assessment based on the Institute of Internal Auditors (IIA) standards, from IIA Korea, an independent external professional organization. The Company also won the 'Internal Audit Innovation Award' from IIA Korea in recognition of our commitment to high internal audit quality and continuous quality innovation.

To continually strengthen the audit organization's capabilities, the Company actively encourages participation in various training programs and the acquisition of professional certifications. The Company also uses Audit Command Language, a specialized audit software, to conduct in-depth data analysis to detect anomalies and gaps. In this way, S-OIL promotes corporate value through an exemplary audit system, including an objective and independent audit committee and audit and audit organization, an effective audit system on par with leading with leading global companies, and audits that focus on process improvement.