● ‘Innovative transition’ to petrochemical(RUC/ODC) helps S-OIL enjoy the most out of business diversification

- ‘Earning surprise’ for two quarters in a row despite bearish refining margin

● Refinery optimization around new state-of-the-art facilities ... rosy expectations for second half of the year

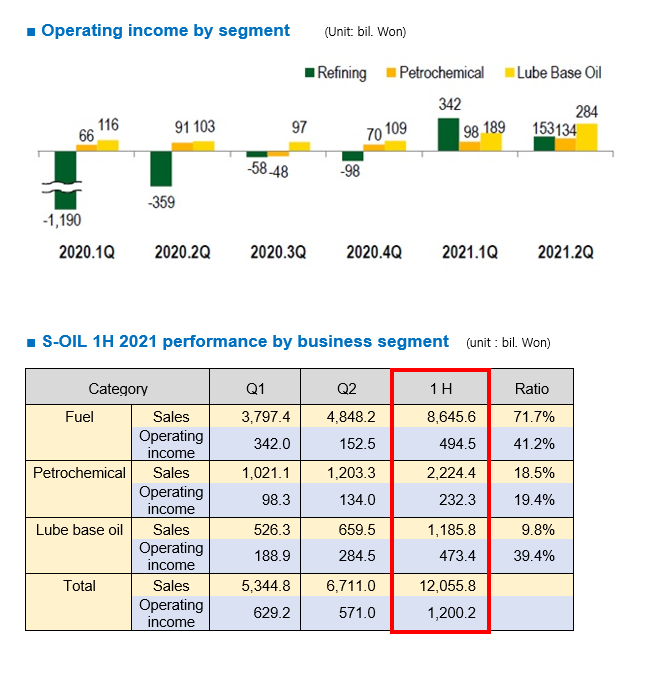

S-OIL(Representative Director Hussain Al-Qahtani) recorded record-high half-year performance driven by mega petrochemical investment based on innovative thinking. On Jul. 27th, S-OIL shared its preliminary 1H 2021 operating income of 1.2002 trillion Won, which tops 1.1326 trillion Won in 1H 2016.

This is an ‘earning surprise’ for the refiner, which posted 571 bil. Won in 2Q operating income following 1Q(629.2 bil. Won), which sustains its positive earnings for three quarters in a row from 4Q last year. Sales revenue in 1 ~ 2Q totals 12.0558 tril. Won, which is a 39.4% spike from the same period last year(8.6502 tril. Won)

What draws even greater attention to S-OIL is how it exceeded the market consensus and beat the weak Singapore refining margin. Despite inventory-related gains going down by more than half from the previous quarter (286 bil. Won → 139 bil. Won) margin of major fuel products including gasoline and diesel stayed robust, which translated to an 11.6% and 25.6% jump in sales volume and sales revenue.

S-OIL said decline in Singapore refining margin was caused largely by bearish heavy distillates price, which forced simple refining facilities in the region to cut their throughput. This did not hold the same for S-OIL as it treats fuel oil into the new upgrading facilities(RUC) to produce gasoline and propylene(petrochemical feedstock). As a result, S-OIL was able to maintain facilities’ throughput up to maximum capacity and maximize profitability. Spread of heavy distillates (HSFO-Dubai benchmark crude) dropped from $-4.9/barrel in 1Q to $-7.8/barrel in 2Q. By contrast, spread of gasoline, which is S-OIL’s key fuel product, surged by 58.8% from $5.1 to $8.1. Sales volume also went up by 11.6% compared to the previous quarter.

■ S-OIL reaping significant benefits from petrochemical complex (RUC/ODC)

S-OIL’s remarkable performance stands out more as its income source is diversified further by the stable operation of new petrochemical facilities(RUC/ODC). In the first two quarters of the year, petrochemical and lube base oil, which represent the non-fuel business, contributed to 58.8% of the company’s operating income(705.7 bil. Won). In particular, sales of lube base oil business stood at only 9.8%(1.1858 tril. Won) but its operating income took up 39.4%(473.4 bil. Won) of the company’s gross operating income. Fuel business contributed to 71.7% of sales (8.6456 tril. Won) and 41.2%(494.5 bil. Won) of operating income to show that S-OIL has a well-balanced business portfolio.

S-OIL’s strategic decision to schedule T&I for its key facilities in 2~3Q, 2020 also proved highly successful. In 2~3Q, the refining industry faced the worst-ever business environment triggered by COVID-19. Demand for fuel products and refining margin both went south and all refiners suffered a huge inventory valuation loss. Thanks to rescheduled T&I, S-OIL was able to run all its facilities at full capacity since 4Q last year without interruption. Throughput for crude refining is 98.8%, hydrocracking 103.9%, olefin production 109.7% and lube base oil 101% in full operation.

Early this month, S-OIL achieved 8 million zero-incident man hours recording zero personnel safety incident in its Onsan Refinery for 627 days from Oct. 22nd 2019. This is the longest-ever in the history of the company and only further added momentum to the company’s safe operation.

■ Al-Qahtani CEO who marks his second anniversary earns spotlight for his ‘crisis management’ leadership

All these achievements are shedding light to CEO Hussain A. Al-Qahtani’s leadership during crisis times. Since joining the company as CEO in Jun. 2019, he has undertaken many activities including the successful completion of RUC/ODC Inauguration Ceremony, commercial operation at the end of the year and operational stability. On this basis, CEO Al-Qahtani made strategic decisions to maximize economics through Refinery-wide optimization and efficiency improvement, which are driving up the company’s performance.

Optimized Refinery operation around state-of-the-art petrochemical complex and maximum high value production are also making S-OIL’s outlook in the remaining part of the year optimistic. A source at S-OIL said improving global economic activities and subsequent increase in demand for transportation fuel will likely benefit refining margin. PP and PO, which are the company’s main petrochemical products, are expected to enjoy a boost driven by healthy demand recovery. Lube base oil is also set for strong spread as demand for high-quality lube base oil products remains firm.

These are all positive signals for S-OIL’s future growth. At present, the refiner is preparing for Shaheen Project as a follow-up to RUC/ODC to more than double its petrochemical yield and diversifying its business portfolio. The refiner is also actively exploring new businesses. Recently, it made an equity investment into FCI, which manufactures hydrogen fuel cells.