● “Record-high” performance through investment in RUC/ODC for innovative conversion to petrochemical business

- Maximized the production of high value-added products by fully operating all production units at Ulsan refinery

- Achieved earnings surprise despite declined Singapore refining margin

● 36% of lube base oil’s operating margin··· balanced profits generated from non-fuel businesses

S-OIL (CEO Hussain A Al-Qahtani) achieved a remarkable business performance with its innovative conversion through large-scale investment in petrochemical facilities. On April, 27, the refiner reported its provisional operating profit of 629.2 billion won in the 1Q of 2021, the highest quarterly operating income since 2Q of 2016 (640.8 billion won). Its sales reached 5.3448 trillion won, up 24.9% from 4.2803 trillion won from the same period last year.

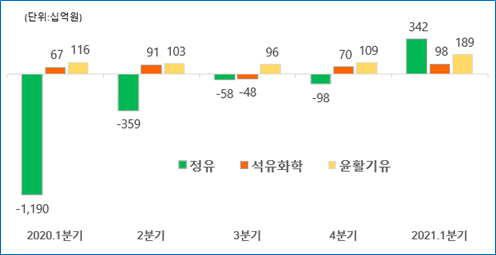

Thanks to its well-balanced business portfolio, which is mainly comprised of refining, petrochemical and lube base oil businesses, the Company was able to swing to positive territory from losses suffered in 2020. The refining business raked in 3.7974 trillion won in revenue with 342.0 billion won of operating income.

The petrochemical business generated 1.0211 trillion won (+24.2% QoQ) of revenue with 98.3 billion won (+39.7% QoQ) of operating income. The lube base oil business’ sales reached 526.3 billion won, recording 188.9 billion won of operating income. Operating margin on lube base oil stood at 35.9% contributing to 30% of the Company’s total operating income despite the fact that its revenue only accounts for 9.8% of the total revenue. In total, non-refining businesses generated 45% of the total operating income.

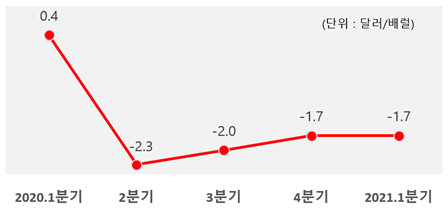

S-OIL’s surprising performance of doubling the market consensus is drawing attention because the achievement was made while Singapore refining margin stagnated at -$1.8 per barrel since the fourth quarter last year due to the spread of COVID-19.

S-OIL explained at its earnings conference call for the first quarter of 2021, “On the back of global demand recovery, spreads (a price differential between Product and Diesel) of S-OIL’s major products, gasoline and diesel, improved by $2.1 ($3.0→$5.1) per barrel and $1.4 ($4.3→$5.7) per barrel respectively compared to the previous quarter. In the petrochemical business, strong margin of polypropylene continued while the upward trend for propylene oxide, which started in 2nd half of last year, remained intact. Moreover, a longer than expected tight supply of lube base oil significantly widened the spread to the level of that in the boom market. Therefore, the Company’s Ulsan refinery focused on maximizing the production of highly profitable products while maintaining the maximum operation rate.”

■ Operation of entire production units at maximum to make the most of the competitiveness of RUC/ODC

We witnessed S-OIL becoming the only refiner in Korea to successfully turn a profit (81.7 billion won) in the final quarter last year and achieving a record-high quarterly performance in the first quarter this year. And it means that the Company has entered the phase of generating profits out of its investment in RUC/ODC*, new petrochemical complex units. Since the commercial operation at the end of 2018, we completed a large scale T&I for RUC/ODC during the third quarter last year based on the items discovered for improvement and past operation experiences. After the T&I, the Company is running the RUC/ODC units at maximum operation rate.

A source from S-OIL said, “As operation of RUC/ODC units stabilizes, the Company is seeing the result of its innovative conversion “from crude oil to chemicals.”

The refiner hit record-high profits taking advantage of its new facilities’ high cost competitiveness, operation efficiency and production of high value-added products.

* RUC (Residue Upgrading Complex)

RUC is an upgrading facility that reprocesses low-value residue oil, such as heavy fuel and asphalt, which is produced during the process of refining crude oil to gasoline, diesel and jet fuel, into gasoline and propylene. Unlike existing upgrading facilities that focus on the production of fuel oil such as gasoline, S-OIL's new upgrading facilities are optimized to maximize the production of high value-added petrochemical products.

* ODC (Olefin Downstream Complex)

ODC produces propylene oxide (PO) and polypropylene (PP) by injecting propylene produced from Residue Upgrading Complex (RUC). By increasing the proportion of profitable products, the proportion of heavy oils such as high sulfur bunker C, which is cheap with shrinking market, is minimized. With the operation of new facilities, S-OIL was able to minimize the proportion of heavy oil, which is cheaper than crude oil.

Also the outlook of S-OIL’s performance in the second quarter seems rosy considering the fact that its new upgrading facilities are now at the phase of stable operation and all units can be operated reliably without shutdowns as there are no major turnarounds planned this year.

Demand for S-OIL’s olefin products such as propylene oxide and polypropylene, major petrochemical products, is strongly supported by policies to promote consumption implemented by major countries including China and solid recovery of demand for automobiles, home appliances and packaging. Demand for premium lubricant base oil products also recovered rapidly due to a surge in automobile sales, but supply remains very tight as refiners maintain their operation rates lower than those in the past hindering the recovery of production.

“Backed by stable demand growth in the petrochemical and lube base oil markets, it is expected that the business environment will remain favorable for S-OIL for a while,” said a source from the Company. The source also added, “Refining margins are expected to improve gradually as demand for petroleum products recovers due to the limited impact from increasing supply as shutdowns of uncompetitive facilities increase, and demand recovery supported by increasing vaccination rate.”

■ Foraying into new businesses such as hydrogen following the 2nd phase petrochemical project

Following its successful completion of RUC/ODC project, S-OIL is again pushing for Shaheen Project, the 2nd phase investment for petrochemical expansion in order to secure the Company’s sustainable growth even after a paradigm shift is made in the energy industry. With Shaheen (which means “Hawk”) project, the refiner plans to double the chemical portion of the Company’s production from 12%, the current level, to 25%. Currently, the economics review on the project is underway and construction for the project will be immediately commenced upon the final approval of Board of Directors. The target year of completion is 2026. For Shaheen project, a steam cracker that produces 1.8 million tpa of ethylene and other petrochemical feedstock from naphtha, plus an olefin downstream facility that produces high value-added synthetic fibers such as polyethylene (PE) and polypropylene (PP) will be built.

Also, S-OIL announced a new growth strategy “Vision 2030” and, in order to achieve the vision, it is actively exploring and participating in new businesses including fuel cell and recycling while maximizing profits from the existing refining, petrochemical and lube base oil businesses. Recently, the Company built strategic cooperative relationship with FCI, a new generation fuel cell manufacturer, by acquiring 20% of equity. The fuel cell business is a core business to the hydrogen economy.

In addition, the refiner plans to enter the hydrogen industry from production to distribution and sales. To this end, S-OIL is reviewing the business to produce and distribute liquefied hydrogen utilizing green hydrogen and green ammonia through a partnership with its mother company, Saudi Aramco. The Company also considers opening a hydrogen charging station in Seoul and participates in a Special Purpose Cooperation called Kohygen (Korea Hydrogen Energy Network), which was formed to build hydrogen charging infrastructure for busses and trucks

S-OIL’s Operating Income by Business Division

Singapore Refining Margin Trend